Roth Conversions & You: How Smart Investors Are Taking Advantage of Depressed Portfolios

Written By: Matt Jaskolka, Financial Advisor

Let’s face it. 2022 has been difficult. 40-year-high inflation, rising interest rates, a foreign war, domestic concerns, and a seemingly always-declining stock market, are among the headline-grabbers. If there is one word to describe why your portfolio has reacted the way it has this year, that word would be “uncertainty”. Uncertainty makes it challenging for Wall Street to accurately assess where things are headed. Don’t forget – markets are always forward-looking.

With that being said, what can investors do in this environment to better position themselves in the future and possibly reduce their tax liability as well? A Roth conversion. Allow me to explain.

In a Roth conversion, you take previously untaxed money from your existing retirement account or IRA, pay the taxes on it up front, and deposit it into a Roth account where it will grow potentially tax-free. There are many advantages to this strategy, not the least of which is the ability to generate tax-free income moving forward. The caveat is you will have to pay the taxes in the year you convert at your marginal tax rate. Additionally, to be tax-free, any withdrawals from your Roth need to be qualified, meaning they need to be taken after age 59½ and the funds have to have been in the Roth account for at least 5 years.

Common pitfalls to avoid here are withholding taxes from the converted funds and/or not making your estimated tax payment on time. Any funds withheld from the conversion are viewed by the IRS as a distribution and, if you are under age 59½, they will be subject to a premature distribution penalty. Further, if you fail to make your estimated tax payment in a timely manner, the IRS may view the payment as late and charge applicable interest or penalties on the amount of taxes due.

Now let’s address the timing of a conversion. Downturns in the stock market present a wonderful opportunity to convert because you can buy more shares for fewer dollars. Understanding markets generally rise in the long-term, more shares mean more growth. In a Roth, more growth means more tax-free income.

So, how do we know if converting is right for you? Typically, I look for a couple of things when speaking with clients:

- Do you have the cash available to pay the taxes?

- It is ideal to use cash outside of the pre-tax funds to pay taxes when doing a conversion. Any time you withhold funds from a conversion, you’re reducing the potential growth and therefore reducing the potential benefits of converting. Further, as I mentioned above, if you’re under age 59½, you’ll be looking at early withdrawal penalties if you withhold funds from your conversion.

- Is there an opportunity now or in the future when income is expected to be less than a normal year?

- This is very important because with a Roth conversion you are essentially adding to your income in the year you convert. More income creates more potential tax headaches such as:

- Higher marginal tax rate

- Loss of certain tax deductions and/or credits

- Taxation of Social Security benefits

- IRMAA surcharges on Medicare premiums

- This is very important because with a Roth conversion you are essentially adding to your income in the year you convert. More income creates more potential tax headaches such as:

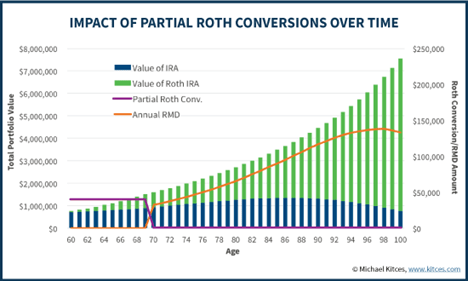

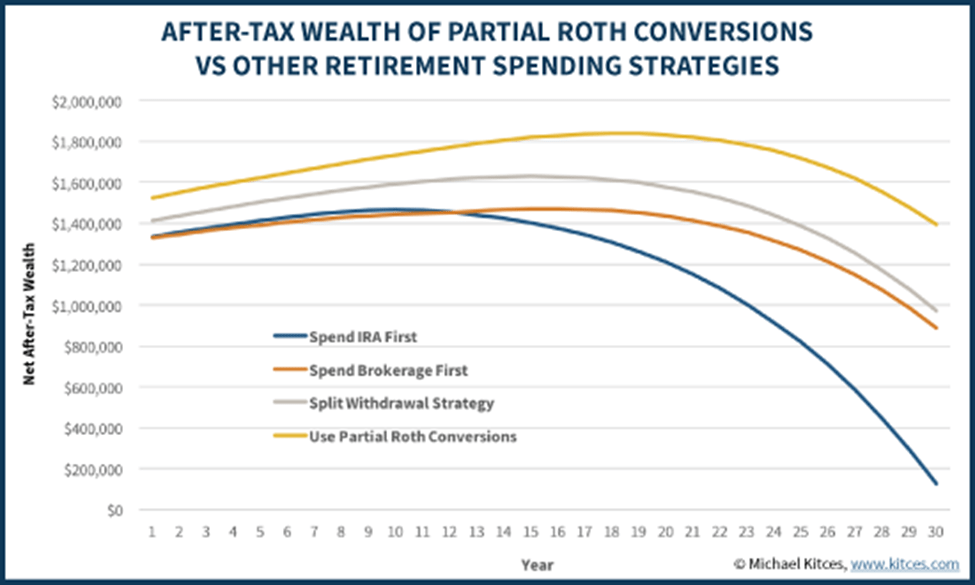

In next week’s article, I will cover how utilizing partial conversions can potentially save you taxes by reducing your Required Minimum Distributions (RMDs). With proper planning, strategizing where your distributions come from can make a large difference in your tax liability and what you leave as a legacy. Be sure to check back next week to learn more!

If you have any questions, we’d love to chat! Call us at 844-CARLSON (844-227-5766) today!

Get on our email list to receive these updates in your inbox!

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a free assessment today or register to attend a seminar.