What Your Banker Might Not Tell You About Refinancing

Written By: Scott Rinehart, CPA

Let’s talk a little bit about envy. While most people might be jealous of their friends’ and coworkers’ new cars and new houses. I’ve always been guilty of a different sort of envy. Interest Rate Envy.

When I bought my first little starter home in 2013, I worked HARD to get my rate down to 3.75%. I was so proud that I was able to borrow for 30 years at less than 4%. According to all my finance textbooks, this shouldn’t have been possible. I couldn’t have been happier.

Until I found out what some of my new coworkers were paying… I remember one bragging about their 3.25% rate. I was mad. I was envious. It was truly proof that everything is relative. Compared to just about any borrower in the history of the United States – I was a winner. But compared to my coworker – I was a loser. I seethed with jealousy over this for years.

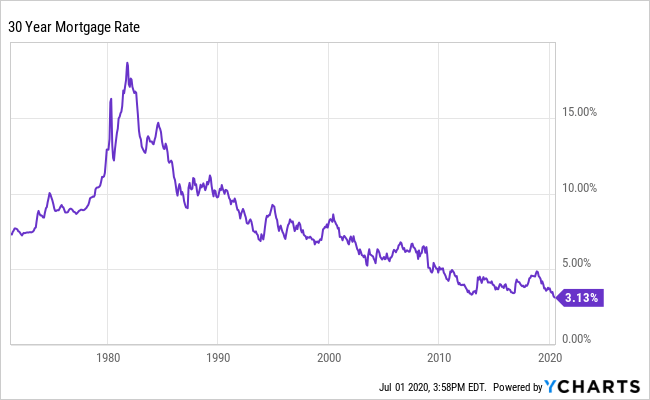

So then in 2017 when my wife and I bought our current home, I was a little frustrated to have to take a 4.00% rate. That frustration quickly subsided though when interest rates started creeping up. The 30-year average mortgage rate hit ALMOST 5% near the end of 2018. So my Interest Rate Envy was subsiding. But then – rates reversed course again and have been in freefall ever since. One of the economic side effects of COVID-19 has been interest rates plummeting to never before seen levels. While this has been bad for those of you with a chunk of money in savings accounts or CDs, it has presented an opportunity for those of us with mortgages.

Refinancings are happening at a pace last seen in 2003, when rates first dipped below 6%. With mortgage rates at fresh all-time lows, refinancing could be an excellent financial decision. Over the last several months, I’ve been recommending anyone with over a 4.0% interest rate to consider refinancing. The past couple of weeks I followed my own advice.

But why should you refinance? Does it ever make sense to not refinance even if you’re getting a lower rate? I want to talk about some of the things your banker might not tell you about refinancing.

Why should you refinance?

All of the reasons below assume that you plan on staying in your home for the long-term. If you think there’s a high probability you will sell within a few years, it might be tougher to justify.

To pay less interest

You should refinance to lower the amount of TOTAL INTEREST you will pay for the property you are financing. This is where Interest Rate Envy could get you in trouble.

Who will pay more in interest? Adam with a 3% interest rate and 7 years left on a 15-year loan? Or Bob with a 6% interest rate and 5 years left on a 15-year loan?

Bob will pay less interest. But what if Bob was like me and fell victim to Interest Rate Envy? If he hears that Adam has an interest rate that is HALF of his own, he might rush a call to his bank to refinance to a new 15-year loan. Shoot, Bob might even be thrilled to find out his mortgage payment is about to be cut by more than half.

But Bob didn’t do the math. He’s going to pay an extra 55% to borrow that same amount of money.

That’s the magic (or maybe curse?) of an amortization schedule. I can almost guarantee your banker won’t bring up an amortization schedule until its time to actually sign the documents (if at all).

Just remember – you pay HALF of the total interest owed over the life of the loan in the first third of your loan term. This means on a 15-year loan, you’ll pay half the total interest in the first 5 years. On a 30-year, you’ll pay half in the first 10 years.

When you are analyzing whether a refinance makes sense, put it in real dollars. For instance, when I bragged to my wife that we were about to lower our interest rate by almost 1%, she gave me some supportive yet unimpressed kudos.

However – when I told her that we’re going to save almost $20,000 in interest over the life of the loan – she showed genuine interest!

Joking aside – get away from Interest Rate Envy and figure out in REAL DOLLARS how much money a refinance will save (or cost) you.

So that’s the first step – figure out how much interest you would pay on the rest of your existing mortgage, then compare that to your bank’s proposal of the refinance.

To add flexibility in your monthly budget

Despite what us finance obsessed folks might wish, reality is much more complex than an amortization schedule. Life is not lived inside of a spreadsheet.

If your current mortgage payment is putting a stretch in your budget, and you’ve already cut out anything frivolous, refinancing can be a good way to give you some breathing room. When you lower your interest rate and extend your loan term, you lower your payment.

This is especially effective if you originally bought your house with less than 20% down, have been paying PMI, and your house has appreciated in value. When you go through the refinance process, the bank will order an appraisal of your home. If your loan balance is now 80% or less of the new home value, you get to wipe out the PMI each month. This could amount to hundreds of dollars each month. Combine this with a lower interest rate, and in a case like this, it may be a no brainer to refinance.

All that being said, this is a slippery slope. Refinancing to lower your payment should not be reason number 1 for refinancing.

To tap into the equity in the home, instead of pilfering your retirement funds

Once again – a slippery slope. If you are frequently tapping into your home equity or your long-term savings, this is probably a symptom of spending too much or earning too little for your current lifestyle. However, tapping into your home equity can make sense if you are going to make home improvements – which will theoretically add value to your home.

If you are under 59.5 and need a decent chunk of money out of either your retirement funds or your home equity – there is a good chance that it will make sense to take it out of the home equity. You could be subject to taxes and a 10% early withdrawal penalty if you choose to take money out of your retirement account early. Using the equity in your home will cost you interest and closing costs – often times lower than the tax and penalty hit of withdrawing from retirement accounts.

A “cash out refinance” basically just means that when you refinance, your new loan amount is going to be higher than before, and the bank will cut you a check for the difference. You’re basically just adding to your loan. That’s the same premise as a Home Equity Line of Credit (HELOC).

Fun fact – HELOCs used to be called second mortgages. It feels a lot better to be using your EQUITY vs. taking out ANOTHER mortgage. In reality – they serve the same function. Gotta love good marketing.

Reasons you might not refinance

If you plan on selling your home before you can recoup the closing costs.

This is one piece of the puzzle that the banker is likely to focus on. For instance – in our case the closing costs are going to look like the following:

Loan Origination Fee – $1,000

Appraisal – $400

Credit Report Fee – $46

Title Work – $46

Mortgage Recording Fee – $180

TOTAL: $2,361

Our monthly payment is going down by $166 per month. So $2,361 divided by $166 equals 14 months to breakeven. If we were planning on moving in the next 14 months – we wouldn’t save ourselves any cash flow.

If you are nearing the end of your mortgage

There you are – so close to the end of the line. Less than 5 years left! And boom – interest rates hit all time lows. Should you take advantage of the low rates and refinance? Maybe take some equity out and invest it in the stock market?

Probably not. As we discussed earlier – the later you are into your mortgage, the less beneficial a refinance will be. Just because your rate might be higher than your neighbors – does not mean you should rush to refinance.

What should you expect when you start the refinance process?

I promise when you call a bank, they are going to be excited to earn your business and will probably tell you what a great time it is to refinance. I certainly don’t fault the bankers for this, they have to make a living, and probably IS a great time to refinance.

The banker is going to highlight how low interest rates are, and if they are decently transparent, they might even tell you right off the bat how long it will take to recoup your closing costs.

After that, the banker is going to gather some documentation from you (statements, tax returns, W-2’s, etc.) and schedule an appraisal. Then they will provide you a Loan Estimate document. This will have all of the important details for you to review before signing on the dotted line.

Once you have the Loan Estimate you can confirm that refinancing is the right choice for you. And maybe, just maybe, you’ll be the subject of your neighbor’s Interest Rate Envy.

Get on our email list to receive these updates in your inbox!

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a free assessment today or register to attend a seminar.