April 2022 Recap

Written By: Dan Moylan, Chief Investment Officer (on May 6, 2022)

I hope you all celebrated Cinco de Mayo with some delicious food! My favorite is a good beef enchilada.

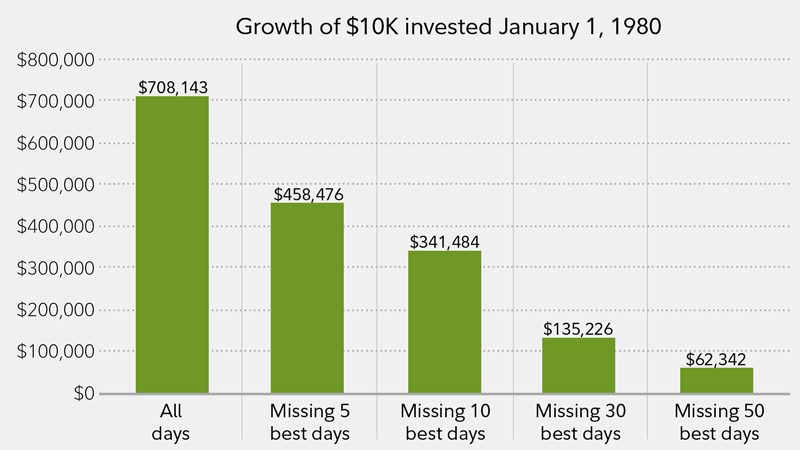

Stocks had a rough April with the Nasdaq off almost 14%, the S&P over 9% and the Dow was off over 5%. You can see the growth stocks, which is represented by the Nasdaq, took the biggest hit because of the concerns over inflation, which is really a concern of how high interest rates will rise in response which too high too fast inhibits economic growth. Most of your accounts own some value stocks that have helped us not drop as much as the Nasdaq, but as you know, we are overweight growth and growth is currently pain. Many of you probably wonder why don’t we get you out of the market? The market timing strategy gets a lot of consideration in this atmosphere, but the real conversation with this strategy is when do you get out, what do you do with the cash and when do you get back in. As you all know, we don’t hold to this market timing question and are bullish long term growth stocks, which can be supported by a strong consumer (high demand) and a strong jobs market which leads to economic growth, not contraction. Scott Rinehart provided us the below chart which is and indication of what the costs can be when using the market timing strategy over the long term.

Source: https://www.fidelity.com/viewpoints/investing-ideas/six-tips

One thing we have done over the last couple months is include inflation hedges in most accounts with commodity type stocks such as energy and mining companies. These companies generate good dividends and have generally out-performed the growth stocks. We are adding to our overweight large cap stocks by trimming some positions in the small/mid cap growth ETF and equities and buying large cap growth and value. We are still overweight TECH but more in the large and mega caps. Three contrarian arguments for the second half of 2022 being extremely strong economically for the U.S.: 1) The supply chain backup is getting resolved. The ports have moved through much of the backup and are in position to handle bigger supplies from China. Bigger supplies will slow inflation. 2) The fed will be very deliberate with interest rate hikes as indicated by Chairman Powell in the last FOMC meeting. 3) Look outside, everyone is going to games, vacations, concerts, restaurants, and any number of other services. Right or wrong, the U.S. consumer says we are done with COVID and now we need to make up for the two years we missed. Demand is high, hopefully our logistics and services companies can figure out how to supply it to keep inflation manageable.

For more insight and perspective on the current market volatility, check out Scott’s video where he discusses market corrections, crashes, bear markets and more.

Have a great May, enjoy the day!

If you have any questions, please don’t hesitate to call us at 844-CARLSON (844-227-5766).

Get on our email list to receive these updates in your inbox!

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a free assessment today or register to attend a seminar.