Common Regrets Among Retirees – And What You Can Learn From Them

Written By: Marissa Waldron, CFP®

As the new year begins, many of us are thinking about fresh starts and future plans, especially if retirement is on the horizon. While no one wants to look back with regret, it’s common for retirees to feel that way. Understanding their biggest regrets can help those approaching retirement make better decisions for a more secure and fulfilling future.

1. Not Saving Enough

The first major regret many retirees have is not saving enough for retirement. A report from the Transamerica Center for Retirement Studies1 found that fewer than 1 in 4 retirees feel confident in maintaining a comfortable lifestyle throughout their retirement. The average household savings – excluding home equity – are only $71,000, which is far from enough for many to comfortably retire. Additionally, 1 in 4 retirees have no home equity at all.

Over two-thirds of retirees wish they had saved more regularly, and half wish they had started saving earlier. Many older retirees didn’t have access to retirement savings plans like 401(k)s, so their savings habits were less developed Many didn’t prioritize their financial future until their 40s or 50s.

Lesson: Start saving for retirement as early as possible. Even small contributions made early can grow significantly over time.

2. Tapping Social Security Too Soon

A common mistake among retirees is claiming Social Security benefits too soon, which locks in lower monthly payments. The average age at which retirees begin receiving benefits is 63, but nearly 30% of retirees start at age 62, the earliest possible age, resulting in a significantly reduced benefit. On the other hand, delaying benefits until age 70 can increase payments by about 8% per year.

While there are valid reasons to claim early, such as health issues or financial constraints, delaying Social Security can provide a much more secure income in the long run.

Lesson: If you can afford to wait, consider delaying your Social Security benefits to maximize your monthly payments.

3. Retiring with Too Much Debt

Almost half of retirees say that debt prevented them from saving enough for retirement, according to the Transamerica report. Even after retirement, nearly 7 in 10 retirees report carrying outstanding credit card debt, up from 4 in 10 just a few years ago. Additionally, 1 in 3 retirees find their spending exceeds what they can afford, which only worsens financial strain in retirement.

Lesson: Aim to reduce or eliminate debt before retiring to prevent it from undermining your financial stability during retirement.

4. Timing of Retirement

Some retirees regret retiring earlier than they could afford to. The financial benefits of staying in the workforce longer are clear—more time to save, invest, and delay Social Security claims, all of which help ensure a more comfortable retirement.

However, many people are forced to retire earlier than planned due to health issues, disability, or unexpected changes in their employment situation, such as employer downsizing. In fact, nearly 60% of retirees retire earlier than expected, and only 1 in 5 retire early because they are financially able.

Lesson: If possible, delay retirement for a few more years to maximize savings and give your retirement funds more time to grow.

5. Lack of Transition Planning

Retirees often regret not preparing for the emotional and psychological transition into retirement. Many fail to answer important questions such as, “What will I do next?” or “How will I spend my time?” Without a plan for this new phase of life, retirees may feel adrift, especially if their identity was tied to their career.

Many retirees regret waiting too long to give themselves permission to retire or to step away from the work identity they held for so long.

Lesson: Prepare for the emotional aspects of retirement. Having a plan for how to stay engaged, pursue hobbies, and redefine your purpose in retirement will make the transition smoother.

The Positive Side of Retirement

Despite these regrets, the majority of retirees are happy and fulfilled. Many enjoy better relationships with family and friends, a more active social life, and a positive outlook on aging. According to Transamerica data2, more than 40% of retirees report increased happiness and satisfaction since leaving the workforce. In fact, many retirees are spending more time on hobbies and with loved ones than they initially expected.

Interestingly, over half of retired women rate their financial health as good or very good, compared to only 38% of those still working. This highlights that many retirees, even those who didn’t start saving early, feel more secure in retirement than they did during their working years.

Dad Joke of the Week:

What do clouds wear beneath their pants? Thunderwear.

Say What?

In freezing temperatures, swimmers in China plunge into a river for health and joy

In air temperatures of -13 degrees in Celsius (8.6 degrees Fahrenheit), swimmers carved a pool out of the icy waters of the Songhua River in the northeastern city of Harbin. The frigid swim was the culmination of a year of daily training.

This week in history

1809 – Edgar Allan Poe is born

1919 – Post-World War 1 peace conference begins in Paris

1977 – President Jimmy Carter pardons draft dodgers

1997 – Ireland grants a divorce for the first time in the country’s history

2020 – First confirmed case of COVID-19 found in the U.S.

What did it cost? (Honda Accord)

1975 – $8,845

2005 – $17,510

2025 – $24,000

Have any questions? That’s what we’re here for! Call us at 844-227-5766 today!

Get on our email list to receive these updates in your inbox!

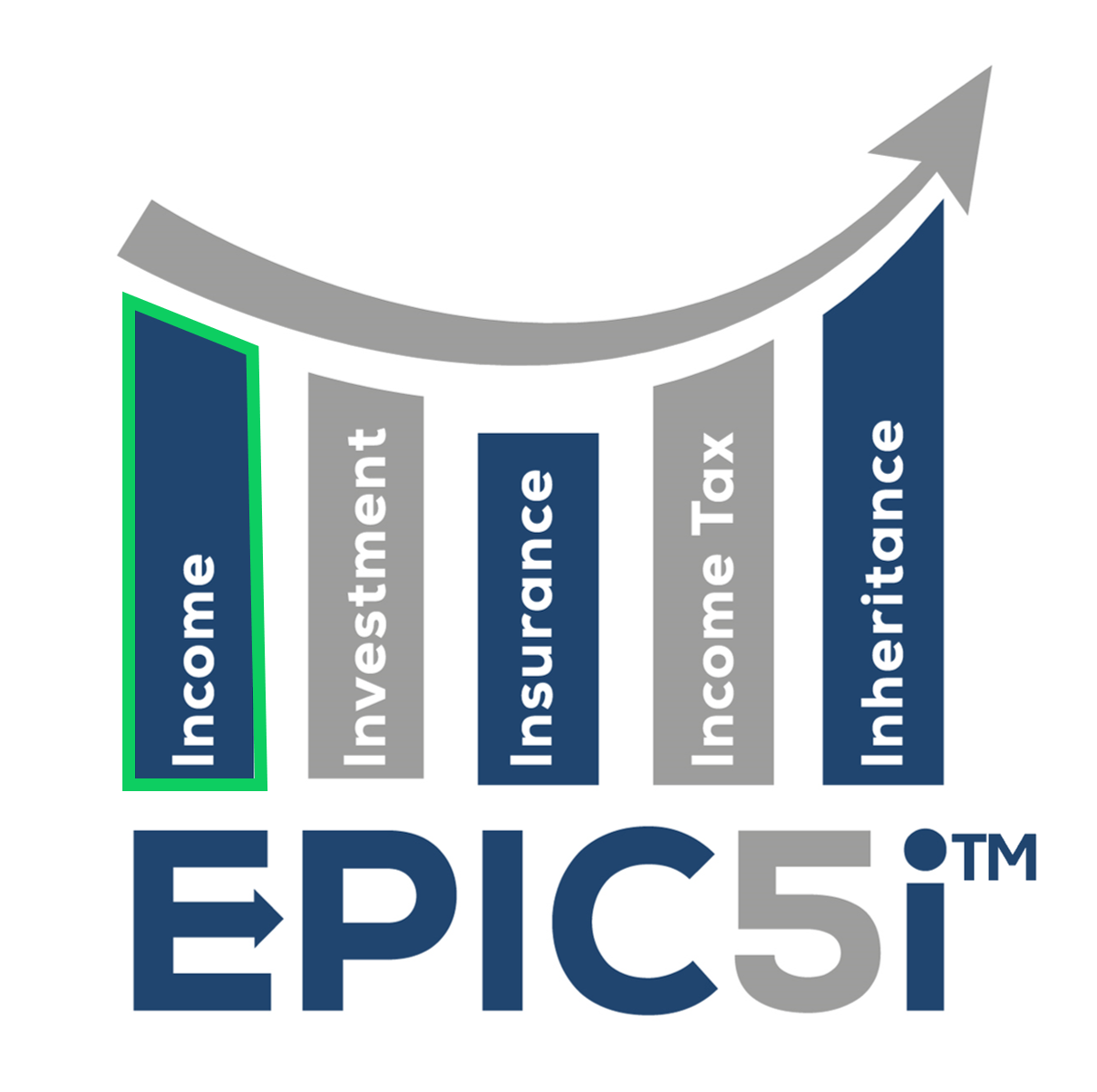

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a free assessment today or register to attend a seminar.