Election Years: Historical Trends

Written By: Alex Hammersley, CPA

Presidential election years often bring about a mixture of anticipation and uncertainty in the stock market. With shifting political landscapes and policy proposals, investors often wonder how the outcome of the election will impact their portfolios. However, history has shown that while election years can introduce volatility, they also present opportunities. In this blog, we’ll explore the typical patterns of the stock market during presidential election years and offer insights to help investors navigate this unique environment.

Historical Trends

Volatility: Presidential election years tend to see increased market volatility compared to non-election years. Uncertainty about potential policy changes and the direction of the economy can lead to fluctuations in stock prices.

Pre-election Jitters: In the months leading up to the election, markets may experience heightened volatility as investors react to polls, debates, and candidate policies. This period often sees increased trading activity as investors position themselves based on election outcomes.

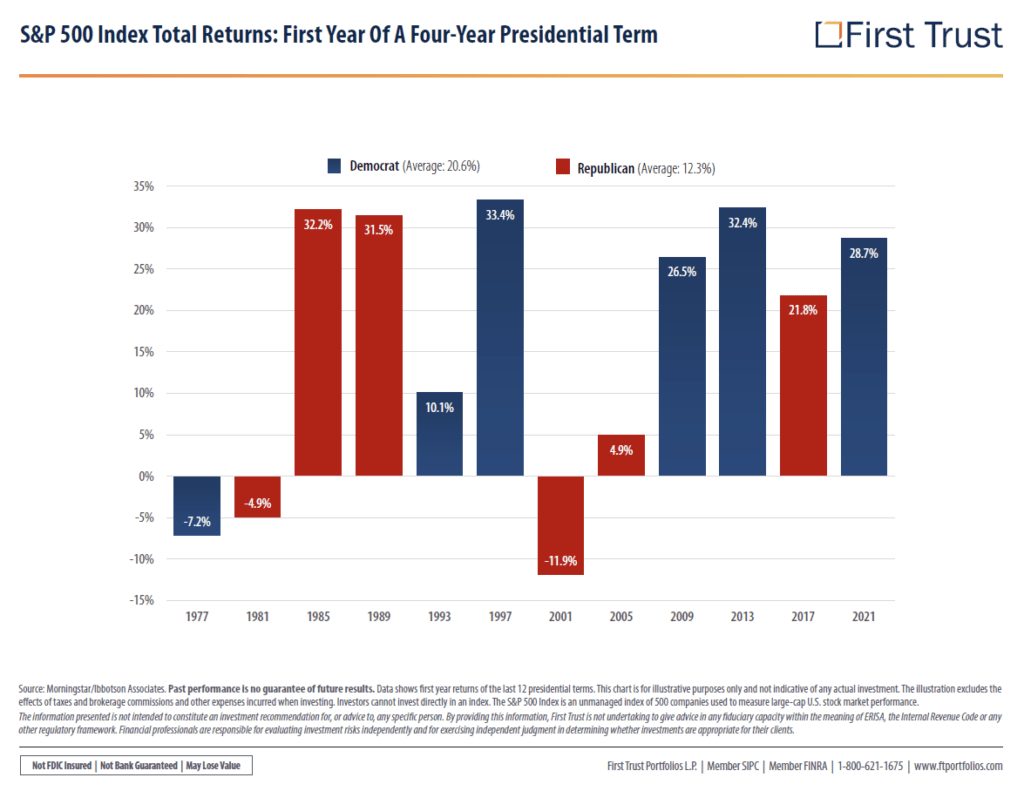

Post-election Rally: Regardless of the election outcome, the stock market has historically exhibited a tendency to rally following the election. This “relief rally” is driven by the resolution of uncertainty and the prospect of policy clarity under the new administration. Below is a chart provided by First Trust showing the performance of the S&P 500 in the first year of a presidential term.

Long-Term Perspective

Focus on Fundamentals: While short-term market movements may be influenced by election-related news and events, long-term investors should remain focused on the fundamentals of the companies in which they invest. Quality businesses with strong financials and competitive advantages tend to weather short-term volatility and deliver solid returns over time.

Diversification: Maintaining a diversified portfolio can help mitigate the impact of election-related volatility. By spreading investments across different asset classes, investors can reduce the risk of being overly exposed to any single market fluctuation. Having a good allocation of “Roof” (riskier assets like stocks) and “Foundation” (safe assets like fixed indexed annuities and money market) will accomplish this.

Investor Behavior

Avoid Emotional Decisions: Fear and uncertainty can lead investors to make impulsive decisions that may not align with their long-term financial goals. It’s important to avoid knee-jerk reactions to election-related news and stick to a well-thought-out investment strategy.

Stay Informed: Keeping abreast of political developments and their potential impact on the economy and markets can help investors make informed decisions. However, it’s essential to filter out the noise and focus on credible sources of information.

Conclusion

While presidential election years often bring heightened uncertainty to the stock market, they also present opportunities for investors who approach them with a clear strategy and a long-term perspective. By understanding historical trends, staying informed about policy implications, and maintaining a disciplined investment approach, investors can navigate the election year landscape with confidence and capitalize on opportunities as they arise.

Have any questions? That’s what we’re here for! Call us at 844-227-5766 today!

Say What?

Local government officials around the country are predicting that everything will come to a complete standstill during the upcoming solar eclipse. State and county officials in the pathway of the eclipse are preparing for the 5-minute solar event by advising people to stay home the day of the eclipse, stock up on supplies in advance to avoid being out in crowded areas. Disaster declarations have been declared in several Texas counties, and schools in Texas, Indiana, Ohio, New York, Pennsylvania and Vermont have announced plans to be closed.

This week in history

1889 (135 years ago) – The Eiffel Tower opened to the public.

1917 – The first woman elected to serve in Congress, Jeannette Rankin, took office.

1973 – The World Trade Center in New York City officially opened. At the time it was the world’s tallest building.

1974 (50 years ago) – Hank Aaron tied Babe Ruth’s home run record.

1984 (40 years ago) – Kareem Abdul-Jabbar broke the NBA’s all-time scoring record.

What did it cost? (Dozen Donuts)

1974 – $1.99

2004 – $6.99

2024 – $9.99

Get on our email list to receive these updates in your inbox!

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a free assessment today or register to attend a seminar.