How Presidential Elections Affect the Stock Market

Written By: Marissa Waldron, CFP®

The conclusion of a long and often contentious 2024 Presidential election resulted in a victory for Republican former President Donald Trump over Democratic Vice President Kamala Harris. With this win, Trump has introduced several proposed economic policies that could signal a significant shift from current strategies. However, as details are yet to be clarified, it remains uncertain how these policy changes may impact the capital markets.

Additionally, with Republicans regaining control of both the Senate and the House of Representatives, Trump’s administration is likely to face fewer legislative hurdles in advancing its agenda. This unified government could expedite the passage of policy initiatives, but the ultimate effect on the economy and markets remains to be seen.

Factors Beyond Election Results Still Driving Markets

While the 2024 election results have been the focus of public attention, it’s crucial to recognize that the investment landscape is influenced by many other factors. Recent economic data shows that consumer spending remains robust, and business investments are holding steady, providing a solid foundation for corporate earnings growth.

The U.S. economy continues to expand, with the third quarter of 2024 seeing an annualized growth rate of 2.8%, nearly matching the second quarter’s 3.0% rise. Meanwhile, the Federal Reserve is being closely watched by markets, with anticipated interest rate cuts of 0.25% in both November and December, potentially lowering the federal funds target rate by a full percentage point compared to its level in September 2024.

Policy Initiatives That Could Shape the Market

A primary focus for the new administration is likely to be tax policy. The Tax Cut & Jobs Act (TCJA) of 2017 is set to expire at the end of 2025, and extending these provisions is a priority for Trump. He has proposed additional tax cuts, which, if implemented, could keep tax rates lower for individuals and businesses. However, this raises concerns about the federal budget deficit, which could drive up bond yields if left unaddressed.

Among his proposals, Trump is advocating for reducing the corporate tax rate to 20%, with an even lower rate of 15% for companies that manufacture products in the United States. He has also proposed eliminating taxes on tips for service and hospitality workers, allowing tax-deductible auto loans, and ending taxes on Social Security benefits.

Another significant policy area under consideration is tariffs. Trump previously imposed tariffs on Chinese goods during his first term, and President Biden maintained many of these measures, even adding new ones. Trump has hinted at more extensive tariffs, although specific plans remain vague. These tariffs could have wide-ranging implications for trade relations and supply chains, potentially affecting market performance.

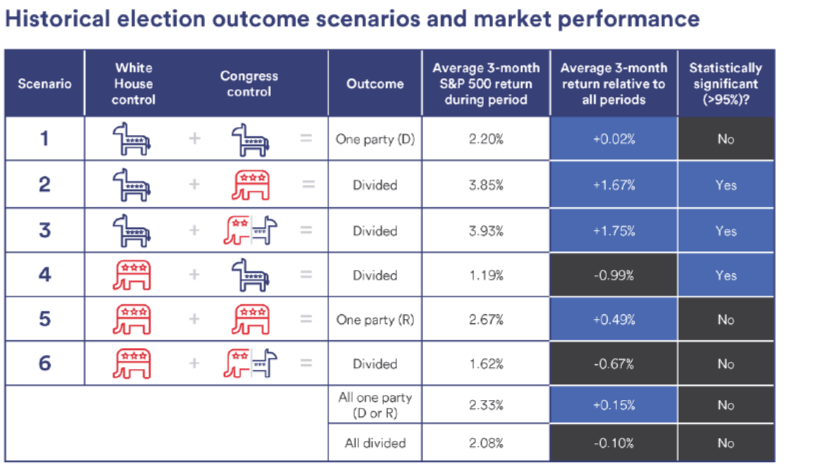

Historical Trends: Economic Indicators vs. Election Outcomes

While investors often focus on how elections might impact the stock market, historical data indicates that economic fundamentals and inflation trends play a more substantial role in shaping market returns. Historically, periods of strong economic growth combined with declining inflation have correlated with above-average market performance. Conversely, slower growth and rising inflation tend to result in more modest returns.

Maintain a Long-Term Perspective

It’s easy to get caught up in the excitement—or anxiety—surrounding election outcomes. However, making investment decisions based on political events often leads to emotional reactions that can be counterproductive. Instead, having a well-thought-out financial plan tailored to your personal goals and risk tolerance is the best way to navigate market fluctuations, whether they’re driven by elections or other external events.

By focusing on economic fundamentals and sticking to a disciplined investment strategy, you can better position yourself to achieve your financial objectives, regardless of who occupies the White House.

Say What?

A New Zealand city waves goodbye to its ‘disturbing’ giant hand sculpture that many came to love

A 16-foot tall sculpture of a hand with a human face named Quasi is being removed from the roof of the City Gallery in New Zealand after five years of controversy

This week in history

1863 – President Lincoln delivers the Gettysburg Address

1877 – Thomas Edison announces the invention of the phonograph

1883 – Time zones are created (because of the railroads)

1907 – Oklahoma enters the Union

1980 – TV history is made as millions tune in to learn who shot J.R. on Dallas

What did it cost? (Tuna, chunk light (6oz. can):

1974 – $0.49

2004- $.79

2024 (5 oz can) – $1.00

Have any questions? That’s what we’re here for! Call us at 844-227-5766 today!

Get on our email list to receive these updates in your inbox!

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a free assessment today or register to attend a seminar.