It’s the End of the Year and I forgot to do WHAT?!

Written By: A. Suzanne Robertson, CFP®

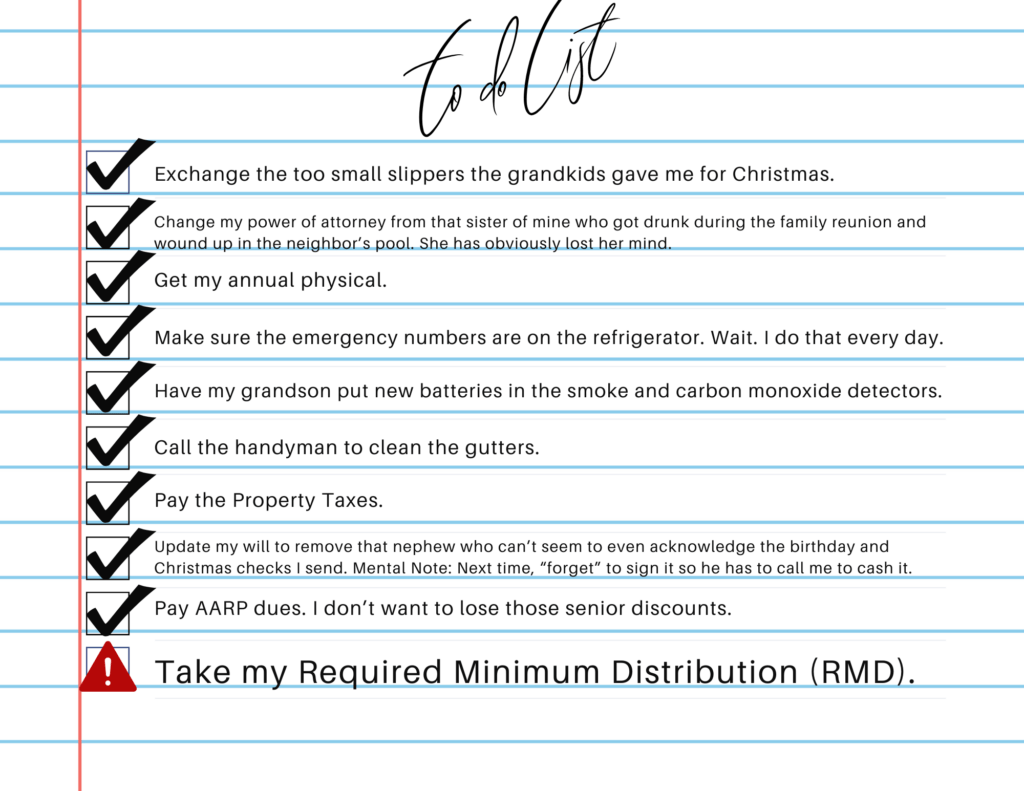

Today is the last business day of 2022. You’ve survived Thanksgiving, Christmas, Hanukkah, and Boxing Day and you’re going through your end-of-year check list.

…Uh Oh… *Blood drains from your face* Wait. What is the penalty for failing to take my RMD? 50%??!! *You start to hyperventilate* Oh Noooo!!!

You proceed to panic. But wait! Secure Act 2 extends the age of those subject to RMD to 73 in 2023! You’re good! Right??? No. If you turned 72 before December 31, 2022 you are subject to RMD withdrawals. Darn. Back to panicking.

You calm down and ask yourself why you’re not working with an advisor who will remind you of these things, then you look at the date and a sick feeling starts to build in your stomach.

Have no fear. Carlson Financial advisors are here to help. While the penalties for not taking your RMD in a timely manner are onerous, the IRS recognizes that mistakes happen and have multiple remedies in place for such an event. Thankfully, in the case of missed RMDs, if corrective action is taken promptly, the IRS has a history under the right circumstances of being pretty lenient about the penalties and interest. The circumstances have to be right, though and part of that means you have to request relief in the proper manner. If you don’t know how to do that, I strongly encourage you to reach out to someone who does.

You will first need to take the missed RMD or RMDs. You have ZERO chance of any penalties being forgiven until this is done. Next, you need to report the mistake on IRS form 5329. You do NOT need to file any corrected returns. The income from your missed RMD(s) will be reported in the year you take it/them. Normally, you would file your 5329 with your tax return for the year you take your distributions, but it can be filed on its own. When you complete the form, you will be required to attach a statement explaining how/why you made the mistake, what you’ve done to fix it, and how you will make sure it doesn’t happen again. IRS guidelines state that a penalty waiver will be granted for reasonable circumstances. Unfortunately, there is no guideline for what is considered “reasonable.” However, presuming the IRS finds you weren’t intentionally trying to circumvent the tax rules, chances are good they will grant the waiver. The key here is knowing how to ask for it.

BONUS CONTENT

Click the image below for some timely reminders on how to protect yourself against Social Security Fraud.

Say What?

Is soup the next hot stock? Cheap, long-lasting foods tend to continue strong sales when the economy is down, but Campbell’s Soup Company has continued to see “boiling hot” earnings. The S&P 500 might be down on the year, but Campbell’s Soup is up about 28 percent. Not only is the company riding the wave of more consumers shopping for inexpensive meals, but the company has used A.I. to comb through 300 billion data points each year in search of new product ideas.

If you have any questions, we’d love to chat! Call us at 844-CARLSON (844-227-5766) today!

Get on our email list to receive these updates in your inbox!

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a free assessment today or register to attend a seminar.