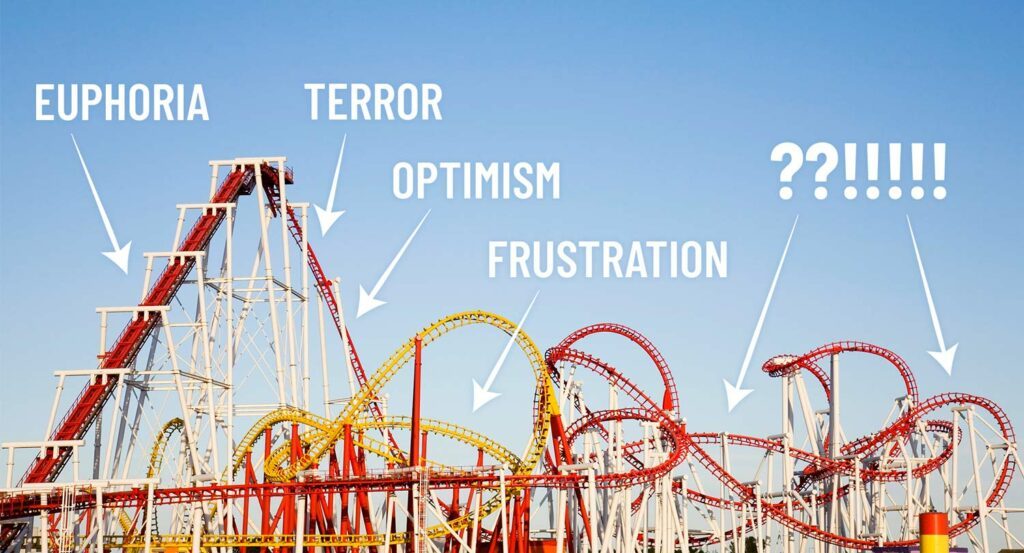

Riding the Rollercoaster

Written By: Anna Carlson

The S&P 500 broke the 5,000 level recently for the first time in history as investors embraced euphoria and rallied.1 And then tumbled as investors got jittery.2 Then yo-yo’d a bit more.

What’s going on?

Let’s talk about investor psychology.

Fear and greed are the two halves of the investor psychology coin.

When investors are feeling greedy and exuberant, they buy in the hopes of making a big profit, driving markets up. When sentiment turns, and they start feeling fearful, they sell in the hopes of avoiding losses, driving markets down.

The rollercoaster of investor psychology can take over and push markets in directions that don’t always jibe with the underlying financial and economic fundamentals.

We’re seeing that push-pull in action right now as investors weigh the likelihood of future interest rate cuts and price out different scenarios.

What positive factors support the rally?

1. Employment is strong, and the most recent report stunned economists with over 350,000 jobs added in January. Though some of the surprise increase can be attributed to seasonal effects, the overall trend is encouraging. 3

2. The U.S. economy may be re-accelerating. The running “unofficial” forecasts by the Atlanta Fed show Q1 economic growth coming in above 3%, trending higher than earlier estimates.4

3. The Fed has forecasted multiple rate cuts in 2024, which would make credit cheaper to access and support business growth.5

What negative factors could trigger a pullback?

1. Pullbacks are normal and expected after markets experience a sustained rally.

2. Inflation is generally trending lower, but the latest data shows prices rose more than expected in January.6 If inflation remains stubborn, it could raise the specter of a “hard landing” recession and spook markets.

3. Investors are counting on interest rates coming down soon. If the Fed indicates it will delay cuts, investors could rethink their optimism.

Bottom line: Volatility is high, and we’ll likely see markets continue to rally and retreat as investors consider their next moves and price in new data.

Have any questions? That’s what we’re here for! Call us at 844-227-5766 today!

Say What?

Americans held more than $1.05 trillion on their credit cards in the third quarter of 2023, and that number is expected to be higher when the fourth-quarter data is released. Aside from consumer debt putting pressure on many Americans, renters have also felt a financial pinch with the median rent for a property with up to two bedrooms has jumped from $1,424 at the end of 2020 to $1,713 at the end of 2023.

This week in history

1922 – The US Supreme Court defends women’s voting rights by declaring the 19th amendment to be constitutional.

1962 – Wilt Chamberlain scores 100 points for the Philadelphia Warriors in a 169-147 win over the New York Knicks.

1983 – The final episode of M*A*S*H aired.

2014 (10 years ago) – In February and March 2014, Russia invaded Ukraine and start the process to annex the Crimean Peninsula.

What did it cost? (Bacon)

1974 – A pound of bacon cost $1.32

2004 – A pound of bacon cost $3.38

2024 – A pound of bacon costs about $6.60 today

1. https://www.cnbc.com/2024/02/11/stock-market-today-live-updates.html

2. https://www.cnbc.com/2024/02/13/stock-market-today-live-updates.html

4. https://www.atlantafed.org/-/media/documents/cqer/researchcq/gdpnow/RealGDPTrackingSlides.pdf

5. https://www.cnbc.com/select/when-will-interest-rates-drop/

Get on our email list to receive these updates in your inbox!

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a free assessment today or register to attend a seminar.