Social Security: No Call for Panic

Written By: A. Suzanne Robertson, CFP®

After dinner presentations, I like to circulate around the room to answer any questions guests might have. Sometimes, if I finish my presentation early or the food is running late, I’ll open the floor to questions. Recently, the most common theme centers around Social Security and fears of impending cuts or loss of Social Security altogether. The purpose of this article is to help answer some of the questions floating around and give you a little bit more peace of mind about your retirement future.

First, let me just say, it is my humble opinion that reports of Social Security’s impending doom are greatly exaggerated.

It will help to start with understanding Social Security and how it works. At its most basic level, Social Security payments are divided into two categories, each with its own trust fund. The first is the Old Age and Survivors Income (OASI), also referred to as Social Security Retirement. The second is Social Security Disability Income or SSDI. Both programs are primarily funded through payroll taxes and supplemented by earnings and principal from their respective trusts.

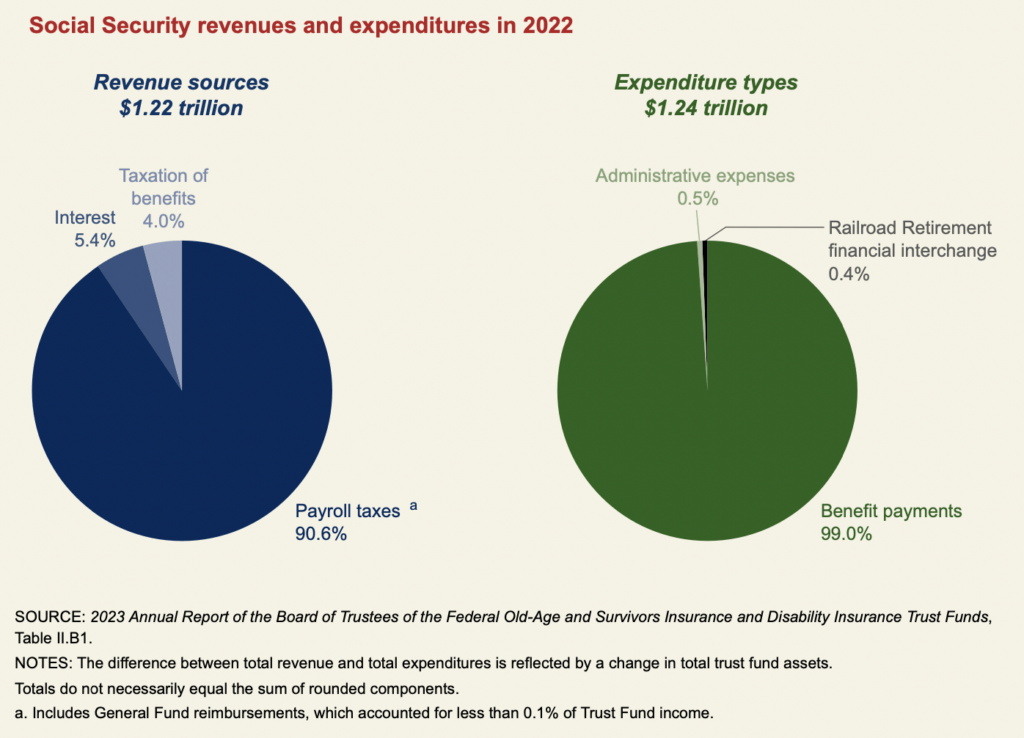

According to the Social Security Administration, in 2022 the Old-Age and Survivors Insurance and Disability Insurance Trust Funds collected $1.22 trillion in revenues. Of that amount, 90.6% was from payroll tax contributions and reimbursements from the General Fund of the Treasury and 4.0% was from income taxes on Social Security benefits. Interest earned on government bonds held by the trust funds provided the remaining 5.4% of income. Meanwhile, in this same time period, expenditures for benefits and administrative costs totaled $1.24 trillion so the total assets in the trust fund dropped.

It is the roughly $20B deficit that leads to reports that Social Security is going “bankrupt.” In reality, Social Security will never be bankrupt so long as we continue to collect payroll taxes. As things stand, payroll taxes alone will cover approximately 80% of current obligations and unless action is taken, Social Security WILL become insolvent and unable to meet its full obligations (currently estimated to occur in 2033).

According to the Social Security Administration, nearly 90% of Americans age 65 or older were receiving a Social Security benefit of some kind as of June 30, 2023, and among Social Security beneficiaries aged 65 and older, 12% of men and 15% of women rely on Social Security for 90% or more of their income.

A 2022 bi-partisan poll by Data for Progress found that 83% of voters support raising Social Security benefits to match current cost of living standards and to ensure everyone who has paid into the program will be able to access all of their earned benefits when they’re of full retirement age (FRA – the age when workers are deemed eligible to collect their full retirement benefit). This would imply the same 83% of voters would oppose cuts to current benefits. Cuts to Social Security benefits, however, are not so straightforward as a reduction in monthly checks. Cuts to benefits could come in the form of simply extending the FRA. In fact, this idea has been floated as a partial solution to preserving the health of program. According to University of Maryland Program for Public Consultation (UMPPC), raising the FRA to age 68 (from its current 67) for workers born 1971 and later would eliminate 14% of Social Security’s projected shortfall. A 2022 survey of 2,545 registered voters conducted by UMPPC revealed approximately 75% of voters would support such a change.

Another proposal is to increase the payroll tax. Currently employees and employers each pay 6.2% of wages. Increasing that to 6.5% would eliminate 16% of the shortfall. 73% of voters in the UMPPC survey indicated they would support this increase. 81% support raising the Social Security payroll tax cap (currently $160,200). Simply reintroducing the current payroll tax on incomes of $400,000 and above would eliminate an estimated 61% of the shortfall. According to a report by the Congressional Research Service, eliminating the cap entirely would affect 5% of American workers and would be estimated to increase revenue by over $150 Billion – fully eliminating the deficit for the next 35 years.

Clearly, Congress has multiple options to fix Social Security, and history dictates they will. After all, NO politician EVER wants to be the one responsible for impoverishing Grandma… at least not publicly. For these reasons it remains my opinion your Social Security check is safe.

Hopefully, this article helped clear the air and eliminate some of the misleading chatter you’ve been hearing.

Say What?

Hershey Pennsylvania is getting ready for fall with pumpkin spiced spa treatments

The article highlights:

The Spa at Hershey Hotel and MeltSpa by Hershey are offering a menu of spa treatments that are “all things pumpkin flavored.” Offerings include a pumpkin spice massage, a pumpkin souffle hydrating body wrap, pumpkin spice body scrub, the Great Pumpkin facial, and pumpkin latte manicure and pedicure.

This week in history

1881 – Chester Arthur becomes the third president to serve in one year, after being inaugurated on Sept. 20, 1881. The year began with Rutherford B. Hayes in office, before James A. Garfield took office in March of 1881. Garfield died in September after being shot by an assassin.

1988 – At the Summer Olympics in Seoul, American diver Greg Louganis wins gold on the springboard after nearly knocking himself unconscious during a qualifying dive.

1989 – Colin Powell was appointed as chairman of the Joint Chiefs of Staff.

Have any questions? That’s what we’re here for! Call us at 844-227-5766 today!

Get on our email list to receive these updates in your inbox!

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a free assessment today or register to attend a seminar.