How to Utilize Partial Roth Conversions to Minimize Taxes & Extend Your Wealth

Written By: Matt Jaskolka, Financial Advisor

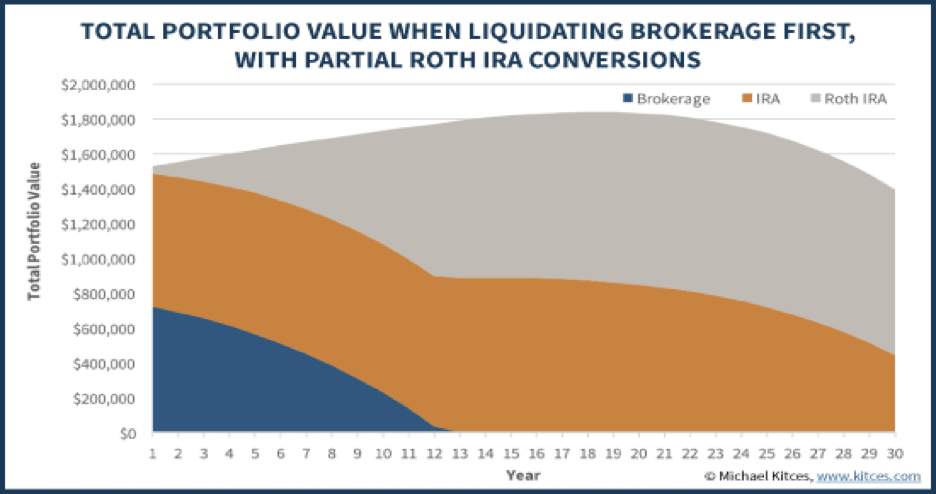

Welcome back. If you missed last week’s blog, I encourage you to take a peek here. Today, we will continue that conversation and explore how Roth conversions can help you maximize income in retirement while minimizing your taxes. In doing so, we’ll start by examining the conventional approach of drawing down your brokerage account first while leaving the funds in your IRA to continue growing tax deferred. By the end, we will uncover why this is not the best approach and the strategy I prefer for my clients.

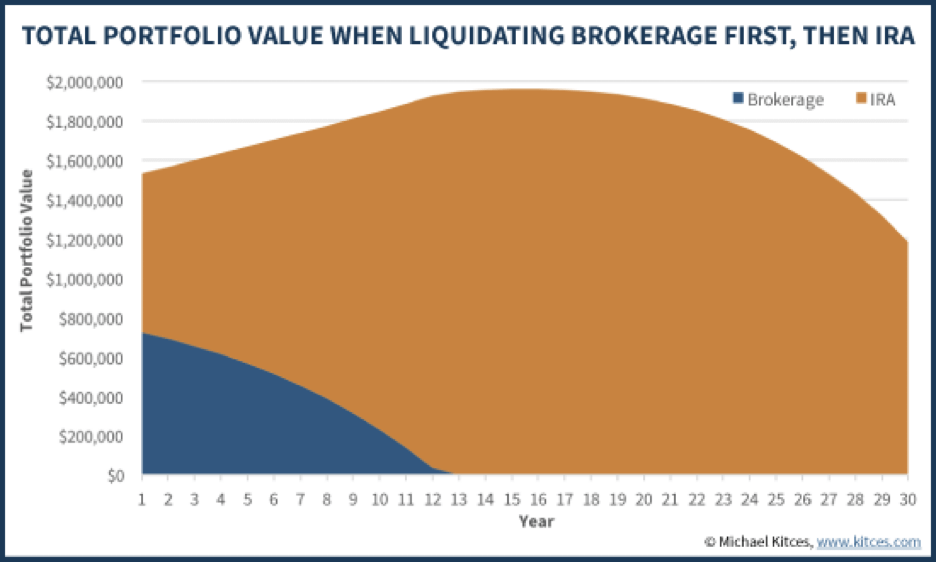

Conventional wisdom suggests liquidating your brokerage account first. There are a few reasons for this. First, you do not want to drive up your taxes in the present year. Second, you want your tax deferred accounts to have the opportunity to grow and maximize the benefits of tax deferral. Third, we presume your money will outlive you. By passing tax deferred funds to your heirs, you pass any taxes due with them. As a result of following this “wisdom,” investors are amassing large amounts of wealth in tax deferred vehicles.

On the surface, drawing from a brokerage account and extending the life, tax benefits and value of an IRA sounds pretty good, but what issues could arise from a larger IRA? Larger Required Minimum Distributions (RMDs). Larger distributions mean more taxes. In 2022, a married couple receiving $2,000 per month or $24,000 per year in social security benefits could only earn or take distributions from an IRA up to $20,000 per year before half of that benefit becomes taxable. A 72-year-old with an IRA of $600,000 is required to withdraw $21,897.81. So, what if both partners are age 72 with combined IRA balances totaling $900,000? Their RMDs will total over $32,000 and they will find themselves paying taxes on an extra $12,000. Clearly, we don’t want that to happen, and you begin to see the limitations of following the conventional route.

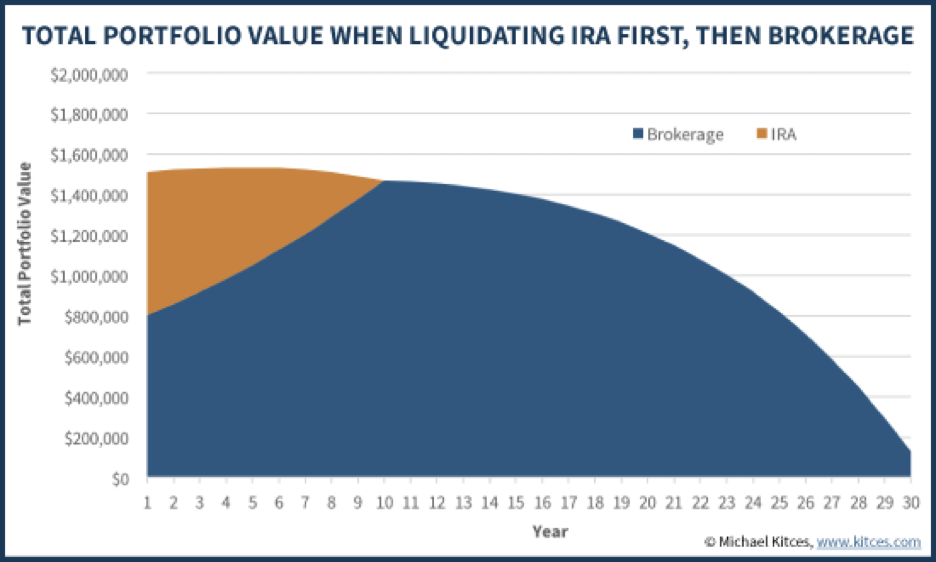

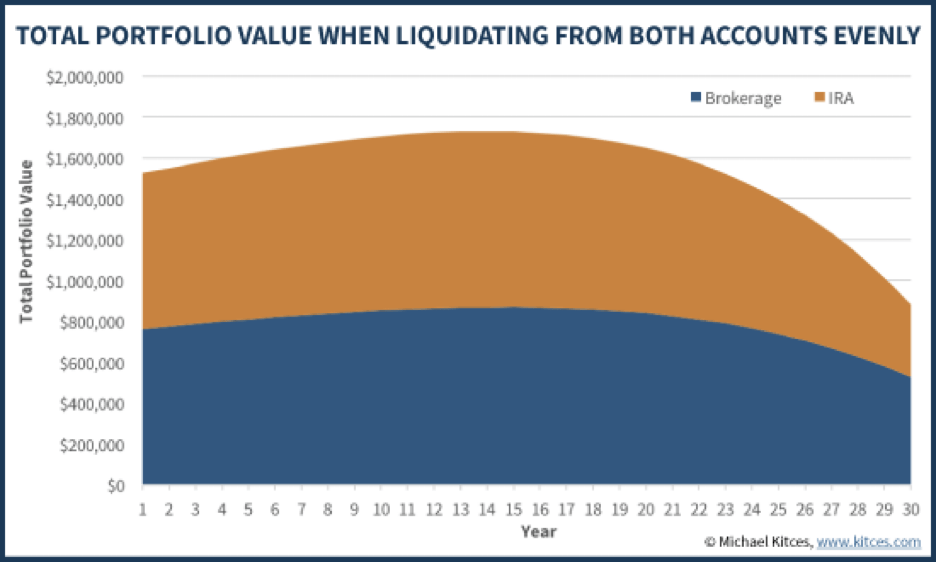

So, what are our options? Well, we could advise this couple to start drawing down against their IRAs early on, but remember, the more they pull from their IRAs, the more they have to withdraw for taxes, and we start to see this couple depleting their accounts much faster than is desired. The alternative is to utilize a blended strategy of drawing from both sources at rates that limit the taxes paid from the IRA and extend the lives of both accounts. But what if this is not enough to keep their RMDs from getting out of control in the future? Let’s take it a step further.

What if this couple had amassed some of those assets in a Roth IRA instead through a Roth conversion? Yes, they would have paid the taxes up front, but reducing their IRA balances by 33% would have reduced their RMDs to less than $22,000 and none of their social security benefits would have been taxable. This is why I recommend doing partial Roth conversions. The more years you can spread this strategy over, the more opportunity you have to max out the lower tax brackets and possibly keep your federal taxes under 12%.

In 2022, the 12% marginal bracket for married couples is $20,550 to $83,550. In 2023, the 12% bracket for married couples will range from $22,000 to $89,450 and their standard deduction will increase to $27,700. In other words, a couple can generate up to $89,450 in taxable income and pay less than 12% in federal taxes. While $89,450 would still leave this couple paying taxes on their social security benefits, the idea here is to start maxing out their lower tax brackets by utilizing conversions before social security comes into play. Furthermore, Roth conversions allow you to reduce assets from your IRA before it becomes problematic, while still taking advantage of tax-free growth under the shelter of the Roth IRA. This allows you to lower future RMD obligations, potentially protecting more of your social security from taxation and generating tax-free income to enjoy in retirement.

If you have any questions, we’d love to chat! Call us at 844-CARLSON (844-227-5766) today!

Get on our email list to receive these updates in your inbox!

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a free assessment today or register to attend a seminar.