Archive for May 2020

Can I Retire?

Will You Be Able to Retire When the Time Comes? Our team recently met with a man we’ll call Joe, who told us about going to his financial advisor. During…

Read More3 Things to Retire

3 Things You Need for a Successful Retirement What does a successful retirement mean to you? While everyone’s definition of a successful retirement is different, there are three key things…

Read MoreFinancial House

Designing & Building Your Financial House When we’re young, we start building a financial house that will hopefully serve us well into our 80s and 90s. But how can you…

Read MoreTax Questions

Questions to Ask Now to Potentially Reduce Your Taxes in Retirement When you enter retirement without a specific strategy for addressing taxes, you could end up paying more than necessary.…

Read More3 Keys to Retirement

3 Keys to Retirement When it comes to retirement planning, you should focus on three key priorities to make sure you create the retirement you deserve: Priority #1: Find a…

Read More5 Top Things When Nearing Or In Retirement

Loss of Spouse

Dealing with the Financial Impact After Losing a Spouse It’s difficult to think about, but an important part of your financial plan includes preparing for what happens if you lose…

Read MoreOne Page Financial Plan

The One-Page Financial Plan If you’ve met with a financial advisor, you know that many factors go into creating a comprehensive financial plan. You’ve probably also gotten a written plan…

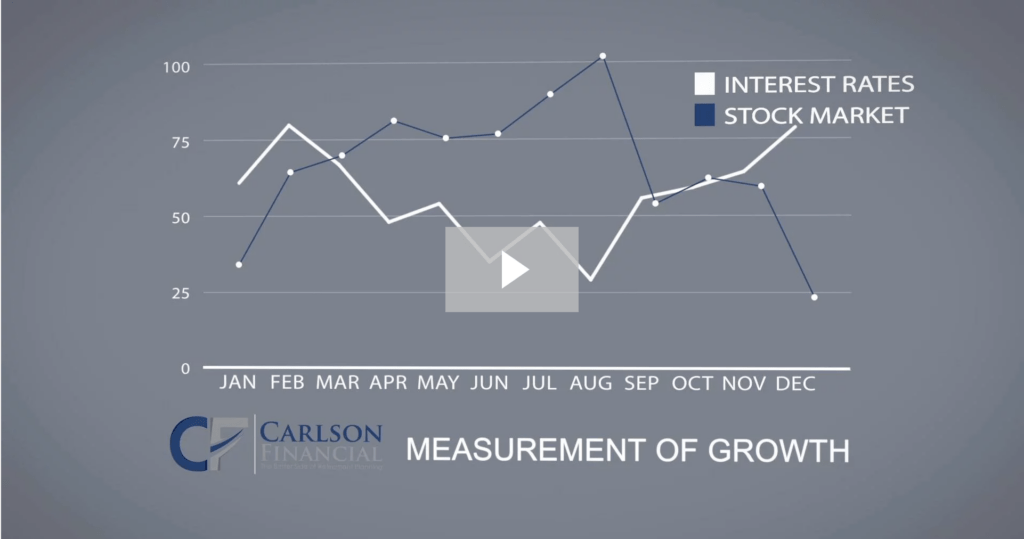

Read MoreDon’t Go From Good To Bad

Are you taking too much risk with your retirement money? Many people come to us with questions about investment planning. One question we frequently hear: Is it possible to earn…

Read MoreRoth Ira

Should You Consider a Roth Conversion? It seems like every week, we meet with a retiree who paid too much in taxes in the previous tax year. Why did this…

Read More